If you have a good plan for your business it can be hard in this economy. Building a business from the ground up and effectively engaging in product marketing takes work and dedication. Many people see forex as an alternative route to making money outside of traditional employment. Find out how you can profit below.

Learning about the currency pair you choose is important. If you try to learn about all of the different pairings and their interactions, you will be learning and not trading for quite some time. Pick your pair, read about them, understand their volatility vs. news and forecasting and keep it simple. Keep it simple.

Consider other traders’ advice, but don’t substitute their judgment for your own. Although others advice is important, you need to make your own investment decisions at the end of the day.

You can hang onto your earnings by carefully using margins. Margin has enormous power when it comes to increasing your earnings. But, if you trade recklessly with it you are bound to end up in an unfavorable position. Utilize margin only when you feel your account is stable and you run minimal risk of a shortfall.

Forex is a complicated investment option that should be taken seriously and not as recreation. People that want thrills should not get into Forex. Gambling would be a better choice for them.

Make sure that you establish your goals and follow through on them. If you’ve chosen to put your money into Forex, set clear, achievable goals, and determine when you intend to reach them by. Make sure the plan has some fault tolerance, as all new traders make mistakes. You should determine the amount of time you can dedicate to learning forex and performing research in addition to trading.

Let the system work in your favor you can have the software do it for you. This could unfortunately lead to very significant losses for you.

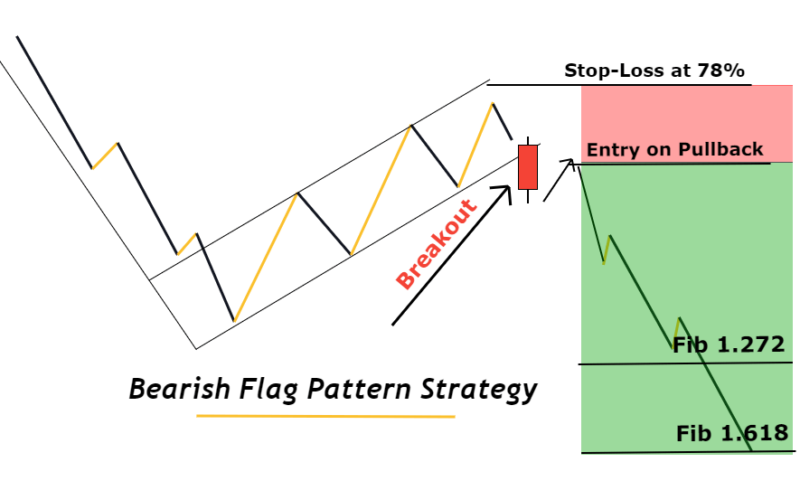

Putting in accurate stop losses is more of an art than a science. When it comes to trading you will have to make compromises between your technical knowledge and how you gut feels about the situation. Basically, the best way to learn how to adequately learn to stop loss is through experience and practice.

There are few traders in forex that will not recommend maintaining a journal. Fill up your journal with all of your failings and successes. Keeping a journal can give you a visual tracking system so you can analyze your results which in turn can help you reach profit gains.

Enable easy trading by selecting an expanded Forex platform. Some platforms can be handled though your smartphone. This makes it easy to trade on the go. Forex platforms that have these extra features offer you fast reaction times. You also get the benefit of flexibility – you don’t have to be tied to your computer to complete trades. You won’t miss investment opportunities simply because you are away from your Internet access at the time.

There is no central area when it comes to forex trading. Nothing can ever devastate the forex market. Just because an emergency or disaster occurs doesn’t mean you need to close out all of your trades. While serious negative events do affect the forex markets, they might not have any impact at all on the particular currency pairs you are working with.

Before setting a position, confirm both top and bottom indicators are set. Even though this is a risky position, you will have a higher chance of succeeding if you wait to be sure.

Forex Trading

Forex trading, or foreign money exchange plan, is devised as a way for you to make money by trading foreign currency. Forex trading can be a good second job or even turn into a career. You need to learn everything you can before beginning forex trading.

Before you begin to trade on the Forex market, make sure you take advantage of the demo platforms where you can hone your trading skills. Using a virtual account or demo platform to trade forex is a great introduction before attempting real time trading.

Create a viable strategy. If you do not have a plan you will not win. You should always stick to any plan you create and avoid straying from it.

Standard Practices

Set a timeline for the how long you plan on involving yourself with forex. This will help you create a good plan. If you plan on going in for the long haul, keep your ears open for standard practices and keep a list. Once you have found some standard practices you want to focus on, spend 21 days trying to solidify these habits in yourself. You become a disciplined investor, and the strategies you have learned will pay off in the future.

Remain calm at all times when forex matters are at hand. Be sure that you maintain your composure. Remember to remained focused. Maintain your composure. If you stay calm, you will be able to make excellent trades.

There are always risks and no guarantees when trading in the forex market. This includes ebooks, podcasts and any other tools. Just use trial and error, and learn from every mistake.

Let your lifestyle determine your trading techniques. If your schedule only allows a few hours for trading, your strategy might be built around delayed orders and a monthly time frame.

If you are down when you reach your stop point, don’t let your desire override limits set when you were in a more logical mindset. Try to step away from trading for a couple days to let yourself calm down.

Now, you need to understand that trading with Forex is going to require a lot of effort on your part. Just because you’re not selling something per se doesn’t mean you get an easy ride. Just remember to focus on the tips you’ve learned above, and apply them wherever necessary in order to succeed.